The Big Four firms have recently

announced their results for the fiscal year 2015. PwC has retaken number one

spot from Deloitte as the world’s largest firm by revenue. KPMG is yet to

announce its results.

A brief overview of the performance

of these firms in comparison with the previous year is as follows.

PwC has recorded a global annual

revenue increase of 10% to $35.4bn (£23.34bn), which represents its strongest

growth in 10 years. Consulting now accounts for more than 30% of PwC’s total

revenues after growing 18% to $11.2bn during the 2015 fiscal year. This was

boosted by the acquisition of Strategy& (formerly Booz & Company) in

April 2014. Revenues

in PwC’s auditing division grew more slowly, rising 6.2 per cent to $15.2bn in

a year marred by the profit misstatement scandal at Tesco, a PwC audit client.

According to Dennis Nally, Chairman

of PricewaterhouseCoopers International Limited,

“As we look at the results for the

last 12 months, all of our lines of service showed really positive growth – led

by Advisory which is up 18%, Tax up 7% and our Assurance business notwithstanding

some really difficult competitive market pressures – up 6%.”

Deloitte refers to one or more of

Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee

(“DTTL”), its network of member firms, and their related entities. Deloitte

provides audit, consulting, financial advisory, risk management, tax and

related services to public and private clients spanning multiple industries.

Deloitte

member firms (Deloitte) reported aggregate revenues of US$35.2 billion for the

fiscal year ended 31 May 2015 (FY15), representing 7.6 percent growth in local

currency terms.

EY

announced combined global revenues of US$28.7b for its financial year ended 30

June 2015. This represents an 11.6% increase over financial year (FY) 2014

revenues in local currency, outpacing FY14 growth (which had increased by 6.8%

over FY13).

All

of EY’s service lines continued to grow in FY15 ahead of their FY14 growth:

Advisory grew 17.6% (vs. 14.4% growth in FY14); Assurance 8.1% (vs. 4.5% in

FY14); Transaction Advisory Services (TAS) 15.5% (vs. 6.5% in FY14); and Tax

10.3% (vs. 4.3% in FY14).

In

FY15, EY headcount reached 212,000 globally – an all-time high.

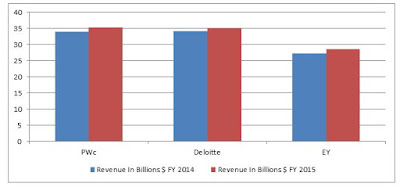

A graphical representation of the performance of these three

firms is shown for comparison purpose.

Head

Count Graph

Revenue Graph

KPMG is due to report its 2015 results

in December. KPMG

International Cooperative ("KPMG International") is a Swiss entity.

Member firms of the KPMG network of independent firms are affiliated with KPMG

International. We are presenting here KPMG’s 2014 and 2013 performance

comparison.

The

KPMG network delivered strong growth and recorded-high revenues of USD24.8

billion for the 2014 fiscal year, an increase of 6.3 percent in local currency

terms over the prior year (2013), recording growth across Audit, Tax and

Advisory.

Head Count Graph

Revenue Graph

References:

- http://www.pwc.com/gx/en/about-pwc/global-annual-review-2015/campaign-site/pwc-global-annual-review-2015.pdf

- http://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx-gr15-summary-final.pdf

- http://www.ey.com/GL/en/Newsroom/News-releases/news-ey-reports-2015-global-revenues-up-eleven-point-six-percent

- https://home.kpmg.com/xx/en/home/media/press-releases/2014/12/kpmg-delivers-strong-growth.html